Ripple Effect: Federal Tariffs & Hawaii's Prosperity

As the world’s most remote chain of islands, and despite her plentiful natural resources, Hawai’i chronically encounters significant challenges in achieving long-term economic stability and sustainability.

Conversations about sustainability rightfully include many interpretations and nuances. The complexity in the subject matter deals with the fundamental goal of achieving a meaningful balance (i.e. a resource’s proper use, as well as its replenishment) between human needs and the resources available to meet them, in the face of fluid and increasingly unpredictable economic influences.

Of those economic influences, the arbitrary application of tariffs by Washington DC presents the most clear and imminent risk to Hawaii’s people and their quality of life.

For 130+ years of American rule, Hawaii’s dependence on imports and tourism to support its overall economy has worsened and deepened. These worsening dependencies are precisely why she is particularly vulnerable to shifts in federal trade policy. The planned increases in federal tariffs and the stifling of international trade, among broader economic uncertainties, are poised to create significant disruptions in tourism, commerce, and the cost of living - key industries and indicators of Hawaii’s overall economic health.

While arguments have been made for the potential benefits of protecting the US’s domestic industries, Hawaii’s unique geographic isolation and stark economic limitations suggest that a historically negative impact is on its way - if it hasn’t already begun under everyone’s notice. The effects of this negative impact will likely exacerbate long-standing, unresolved questions about the priority of locals and native Hawaiians to remain in their generational home beyond the mere ability to afford it, potentially leading to a protracted and culturally-tense recession.

"The Cost of the Colors", AI generated image by Google Gemini.

Tourism’s Receding Tide

For better and worse, tourism is the lifeblood of Hawaii's modern economy, having contributed significantly to GDP and employment over the majority of the 20th century and the 21st. The prospect of increased federal tariffs presents a multi-faceted threat to this once reliable and thriving economic sector.

In 2025, the riskiest impacts stem from potential retaliatory tariffs by other countries, which could immediately deter international visitors. The University of Hawai’i Economic Research Organization (UHERO) notes that international arrivals were already down 3-6%, with double-digit percentage declines in airlift from Japan and Canada, even before the full effects of new tariffs were felt. Canadian visitors in particular have shown a noticeable drop, partly attributed to initial U.S. tariffs and ongoing trade tensions. A stronger U.S. dollar - often a consequence of trade disputes - further makes Hawai’i a more expensive destination for foreign travelers, dampening demand from key international markets.

Beyond the short-term effects to international visitors, federal policy changes (including the anticipated inflationary impact of tariffs on the mainland U.S. economy) could contribute to a decline in domestic tourism as well. UHERO forecasts a 4% decline in total visitor arrivals over the next two years, with a staggering $1.6 billion reduction in real visitor spending by 2026. This reduction in visitor spending has a "rainbow effect," rippling through various segments of the local economy, from restaurants and tourism activities (guided tours, ride shares, souvenir shops, food vendors, etc.) to banks, and retail. Businesses reliant on tourist spending are already reporting significant declines in bookings and overall interest for the remainder of the summer season, with some seeing the slowest June in recent memory.

Complicating the bigger picture, Hawai’i lawmakers are also experimenting with higher visitor taxation. Some proposed bills aim to significantly raise the cost of visiting Hawai’i by cruise ship, with industry estimates suggesting a potential doubling of taxes and port charges for cruise passengers. While Hawai’i locals and native Hawaiians rightfully argue that these fees are about equity, protecting island resources, as well as supporting Hawaii’s out-dated tourism infrastructure, cruise lines have already warned of potentially pulling ships from the Hawai’i market if costs become prohibitive. Furthermore, existing measures like the Transient Accommodations Tax (TAT) are proposed to increase, potentially pushing total taxes on lodging close to 20%, when combined with county surcharges and the general excise tax. These cumulative cost increases, driven by both federal tariffs and local taxation, could make Hawai’i less competitive as a global tourist destination, potentially diverting travelers to alternative destinations that may be more budget friendly.

Hawaii’s construction industry will also be indirectly affected by downturns in tourism. As hotel occupancy rates decline and economic uncertainty persists, capital investments and expansions in the tourism and hospitality sectors are likely to be curtailed. Nearly 67% of businesses surveyed by the Hawai’i Chamber of Commerce reported plans to cut back on capital investments or expansions due to tariffs. Therefore, as investments reduce over time, construction activity and job growth in the sector will slow as well.

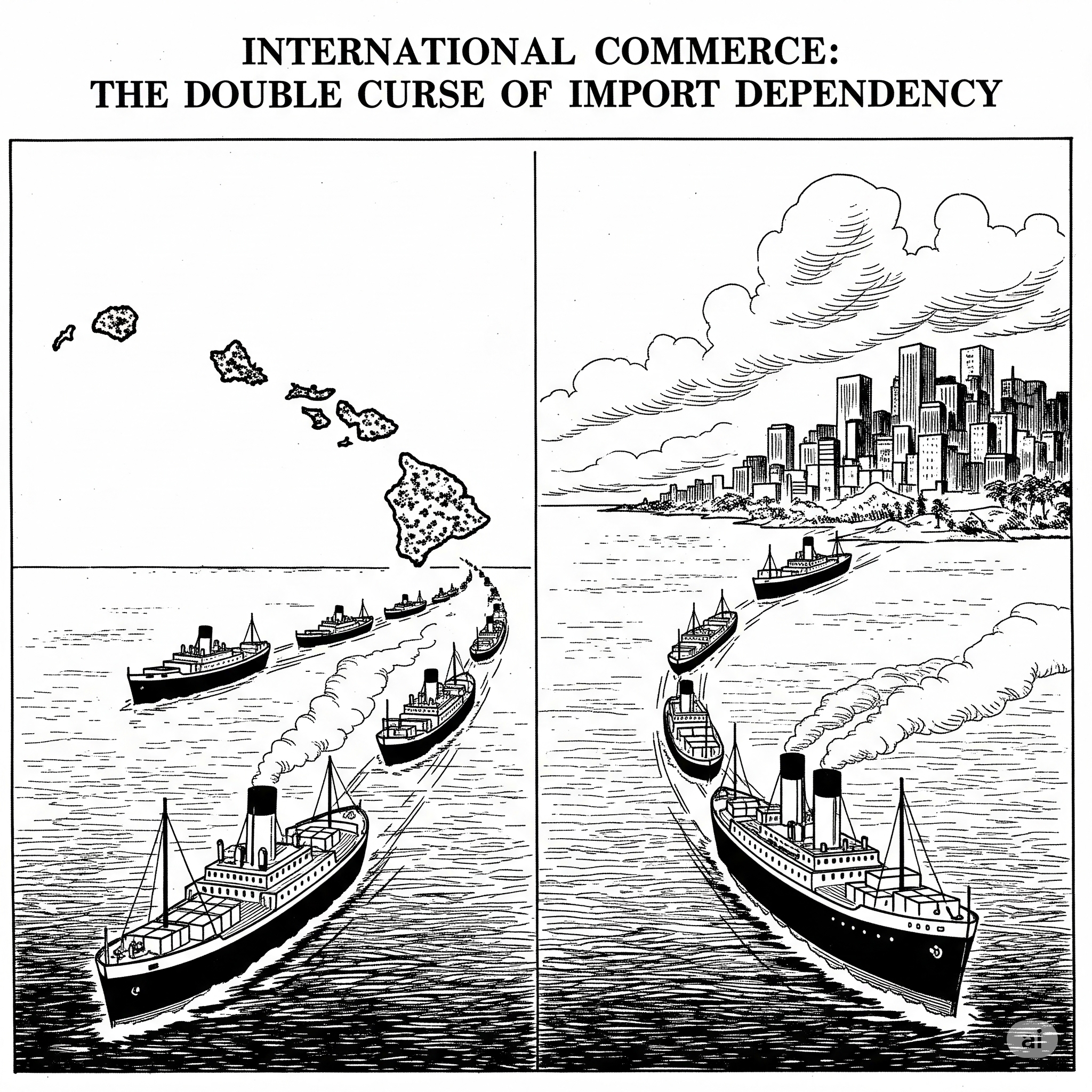

“Import of Call”, AI generated image by Google Gemini

International Commerce: The Double Curse of Import Dependency

Hawaii's extreme reliance on imported goods all but guarantees that federal tariffs will have a profound and immediate impact on international commerce.

By some estimates, the state imports as much as 90% of its food and a vast majority of its consumer products and building materials. Tariffs on goods from countries like China, Mexico, and Canada will directly increase the cost of these essential imports. Tariffs up to 145% imposed on Chinese goods had led some businesses to halt shipments from China entirely, resulting in stockpiled inventory and logistical hangups at island ports. The price of everyday items - from takeout bags for restaurants to high-quality wines and cooking oils - have already seen significant increases in their retail price per unit.

The impacts of tariffs, in this case, also extend beyond direct costs that they add to the price of doing business. Higher shipping costs, influenced by disputes in trade routes and new contracts for longshoremen at U.S. ports, further compound the issue. A recent $1,500 to $2,000 surcharge on some containers moving through Los Angeles to Hawaii has already spiked costs, effectively tripling, quadrupling, or even quintupling how much it takes to bring in certain retail and commercial products. This means that even goods not directly subject to tariffs will inevitably become more expensive due to increased transportation expenses.

While the Fed’s stated goal for imposing tariffs is often to protect domestic manufacturing, Hawaii's uniquely dependent economic structure has almost no large-scale manufacturing that would significantly benefit from such a policy. Some locally grown produce, like papayas, pineapple, or coffee might see a niche competitive advantage, if tariffs make imported alternatives more expensive. However, this limited benefit is unlikely to offset the broad-based increases in costs across nearly all other classes and categories of imported goods. A Hawai’i Chamber of Commerce survey revealed that almost 90% of businesses reported tariffs affecting their supply chain costs and product pricing. This directly translates to higher operational costs for businesses, forcing a choice to either absorb the cost increase, to reduce profit margins and therefore growth, or to simply pass them on to an already strained and increasingly frustrated consumer base.

Beyond questions about how much or little Washington DC values international trade, the mere uncertainty surrounding tariff policies itself is detrimental to international commerce. Businesses are hesitant to make long-term investment decisions when the cost of importing goods can change drastically and unpredictably. This leads businesses to adopt a more conservative approach to major decisions, while possibly postponing new product launches, facility expansions, or new ventures. The cumulative effect of these conditions could lead to a cooling of innovation and creativity in Hawaii’s otherwise diverse and eclectic market.

“Priced out of Possibilities”, AI generated image by Google Gemini

Cost of Living: When Unaffordable Feels Like Unattainable

By most metrics, Hawai’i already has the highest cost of living in the United States. This condition is arguably a byproduct of tourism and import dependency, but is also primarily driven by gentrification, the luxury real estate market, and the inherent expense in transporting goods over thousands of miles of open ocean. Federal tariff increases are poised to exacerbate this challenge significantly, impacting residents across all income brackets.

The most direct effect is on the average price of consumer goods. Since Hawaii imports the vast majority of its food, clothing, furniture, appliances, and even pharmaceuticals, tariffs on these items will lead to across-the-board price hikes. For families already struggling, this will present an insurmountable financial burden, potentially cutting into disposable income by thousands of dollars annually for the average household. The suspension of the long-standing duty-free exemption for imports under $800, which many Hawai’i consumers relied upon for affordable online shopping from platforms like Temu and Shein, means that even small online orders will now incur additional costs.

Hawaii’s construction industry, while key to the local tourism industry, is also a significant driver of housing costs. As the industry suffers from the new economic reality, the cost of renovating, and remodeling will also be hit hard. New home construction will likely slow, if not stall. Increased tariffs, upwards of 25-50%, on building materials like lumber, kitchen cabinets, flooring, and wooden doors will inevitably drive up costs, eventually impacting the overall price of bids. For a state grappling with an affordable housing crisis, this means projects will become more expensive to "pencil out," potentially delaying or halting new developments, and ultimately leading to higher rental prices while making homeownership even more unattainable.

Beyond tangible goods, the ripple effect will likely touch various services. Businesses facing higher operational costs due to tariffs on their inputs (e.g., packaging for restaurants, equipment for service providers, tools for trades people) will likely pass these costs on to consumers by increasing the basic cost for the same service. This contributes to overall inflation, eroding real income gains for households.

The aggregate effect is a significant reduction in quality of life for many native Hawaiians, Hawaii’s generational locals, and all other residents. With wages rarely ever keeping pace with Hawaii’s escalating cost of living, every resident (other than the ultra wealthy) in large and small ways faces the struggle to afford basic necessities. Over time, this growing affordability crisis has led to higher-than-normal turnover rates in hospitality, retail and tourism, as well as staffing shortages, and the necessity of working multiple jobs just to get by. Tariffs will intensify these pressures, potentially leading to further outmigration from the state.

Economic Forecast: Rough Seas Ahead

The economic outlook for Hawaii, under the shadow of increased federal tariffs, suggests a period of significant headwinds and potential contraction. What follows is an educated guess regarding Hawaii’s near term prospects, given the nation’s current economic course.

6-Month Future Window (July 2025 - January 2026):

Within the immediate six-month window, Hawai’i is likely to experience an intensification of the current economic slowdown. Businesses, particularly those heavily reliant on imports, will continue to feel the pinch of increased supply chain costs and product pricing. This will lead to further price increases for consumers, contributing to elevated inflation. The summer tourism season, which was already showing softness, is unlikely to see a significant rebound given continued uncertainty surrounding federal policies. International visitor numbers are expected to remain subdued due to trade tensions and a strong dollar. Job growth will be limited, with some sectors (particularly retail and construction) experiencing stagnation or even modest declines. The Federal Reserve's stance on interest rates is unlikely to ease given the anticipated inflationary impact of tariffs, further constraining borrowing for businesses and individuals.

Because income growth will slow or flatline, because tourism and public employment will shed jobs, and because costs are only likely to rise, a mild recession by late 2025 is a real possibility.

12-Month Future Window (July 2025 - July 2026):

Looking out to the 12-month horizon, the full effects of the tariffs are expected to be more deeply felt. UHERO forecasts that Hawai’i will enter a mild recession by late 2025, with real GDP rising by only about 1% this year and next. Job growth is projected to be near zero statewide in 2025 and even decline in 2026 on islands with less career opportunities and smaller labor bases like Kauai, Moloka’i, and Lana’i. Real income growth will likely remain below 1% through at least 2027. Tourism will continue to face challenges, with visitor arrivals potentially declining by up to 4% over the next two years coupled with a significant reduction in visitor spending. Hawaii’s extremely high cost of living will increase, fueled by tariffs and other factors, putting increasing pressure on generational locals and native Hawaiian households in particular. While some tax relief might be introduced, overall economic conditions will remain uncertain, unpredictable, and ultimately difficult. Businesses, state-wide, may elect to cut back on marketing, advertising, hiring, and staffing to manage increased operational costs.

18-Month Future Window (July 2025 - January 2027):

By the 18-month mark, while a full-blown economic collapse is unlikely, a prolonged period of stagnant growth and elevated costs is highly probable. The U.S.-instigated tariff war also reduces prospects for global growth, further impacting Hawaii's international trade connections. The construction sector, already facing high costs and permitting challenges, will see limited new development. The housing market will remain difficult and even more expensive, with affordability issues exacerbated by increased material costs. While some adjustments in supply chains and consumer behavior might begin to emerge (e.g., sourcing goods from non-tariffed countries), these shifts will take time and may not fully offset the immediate negative impacts. A potential full recovery of visitor arrival numbers is not likely until maybe 2028, indicating a protracted period of decline and adjustment for the tourism sector. Long-term job growth will be limited by an aging population and a slow-growing labor force, compounding the challenges brought by tariffs.

In conclusion, increases in federal tariffs represent a significant economic challenge for people living in every Hawaiian island. Hawaii’s unique characteristics as an import-dependent, tourism-driven economy make it particularly susceptible to the negative ramifications of protectionist policies. While the extent of the impact remains opaque and uncertain due to the dynamic nature of trade relations in the era of Trump, the credible information available points to a future of elevated costs, dampened tourism, and a general economic slowdown.

Hawaii's resilience will be tested as it navigates these headwinds, requiring strategic adjustments from businesses and policymakers alike to mitigate the adverse effects and ensure a stable economic future.